Are you looking to unlock greater value from your residential investment property? Or perhaps you are exploring ways to build some form of passive income or generate cash flow?

Through our Property Management arm, Bespoke Habitat, we can help you to maximise the returns from your rental unit through our Shared Space concept.

What is the Shared Space concept?

We view the Shared Space concept as similar to co-living arrangements but without the community aspect. Through a Shared Space arrangement, you can lease out individual rooms to individual tenants instead of traditional rental arrangements where the entire apartment is leased out under a single contract.

As a landlord under Shared Space model, services such as wifi, cleaning and utilities are bundled as part of the tenancy agreement and made available to the tenant. However, communal living social activities such as organising barbeque, karaoke or food tasting sessions are not included.

How can you monetise the Shared Space?

There are 2 ways of monetising the Shared Space concept.

1. If you already have an investment property, you can rent it out to individual tenants.

2. If you do not own an investment property, you can adopt the rent-to-rent model. This is where you rent an apartment and sublet out the individual rooms to individual tenants.

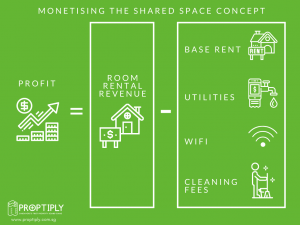

In order to monetise or build cash flow from your Shared Space, you need to have collective rental income that exceeds your expenses. This means the total amount of rent collected from leasing out individual rooms must exceed the base rent, wifi, utilities, cleaning and other expenses.

Profit = Room Rental – Base Rent – Utilities – Wifi – Cleaning Fees

Through the profit or positive cash flow generated, you are able to have an additional income stream.

How we can help you

Our property management services include the following:

1. Shortlisting of suitable properties*

We will help you to shortlist a suitable rental unit to rent.

2. Negotiations with landlord*

We will help you to negotiate for an attractive rental price from the landlord and also help to communicate to the landlord that you intend to sublet the unit out to suitable tenants.

3. Space maximisation

We will help you to design and maximise the spaces in your unit so that you can generate positive cash flow and maximise your rental returns.

4. Get your property rent-ready

We will help you to address any issues which require fixing (such as plumbing, painting, rewiring, mold eradication), install essential appliances such as washing machine and dryer, and give the unit a professional once-over cleaning before your tenant moves in.

5. Tenant screening

We will help you to screen prospective tenants for your rental property and ensure that they meet the ideal criteria.

6. Drawing up the tenancy agreement (rental contract)

We will help you to draw up the tenancy agreement which will also include a set of rules that all your tenants must adhere to in order to so that everyone can enjoy peaceful living arrangements under the same roof.

7. Rental collection and maintenance

We will help you to collect your monthly rental and pay the relevant utilities, bills and arrange for professional cleaning services for your property. The profit generated after deduction of expenses represents your additional income stream.

Note: Steps 1 – 2 are included if you are working on a rent-to-rent model where you rent a unit in order to lease out that unit to generate positive cash flow. If you own the property to be leased out, steps 1 – 2 are not required.

Why us

Experienced

We have more than 50 rental units under our belt and have also been in the property investing industry for many years. As both investors and landlords ourselves, we understand the unique needs of landlords, tenants and investors. We have developed a checklist to help you select a suitable property for rent under the rent-to-rent model and to select suitable tenants with desirable backgrounds.

Excellent service

We are committed to delivering excellent services to both investors and tenants. We understand the features that tenants care about and put in effort to create a conducive home environment for them. Through an easy on-boarding process and our in-house app, we are able to maintain open and timely communication with our tenants. This fosters a good tenant-landlord relationship.

Leveraging on technology

We leverage on our specially developed bespoke in-house app to communicate with our tenants and manage any issues which arise. The app enables us to react quickly to any case lodged by the tenant on the app. The good support structure facilitated by the app enables us to keep tenants happy and is an incentive for them to extend their stay with us.

Reach out to us to find out what we can do for you.